|

Russian Economic Development: Before and

After the Crisis of 2008

Summary

of the presentation given on December 22, 2008, by Boris V. Kuznetsov

The Russian

economy has been demonstrating rather high, if not spectacular,

economic growth for the past 8 years. This growth is commonly

attributed exclusively to high oil prices and high export revenues. So,

the crisis of 2008 in Russia is often looked on just as a consequence

of falling oil prices. While to a great extent this may be true, such

an approach cannot fully explain the scale or the speed of impact the

world crisis of 2008 had on the Russian economy. To better understand

the internal mechanisms of the crisis processes, it is important to

look more closely at the model of growth that evolved in Russia in

2001-2007 and on fundamental problems of the Russian economy and of the

Russian manufacturing industry, in particular.

While export revenues grew very quick due to increasing oil prices as

well as the prices for other raw materials and primary goods (metals,

in particular), they were not translated into high investments until

2006, but mostly resulted in the growth of private consumption. Part of

the consumption demand was for services and non-tradable goods and had

a stimulating effect on the economic growth in those sectors, but

growing demand for other goods had limited influence on the economy.

Russian manufacturing was unable to satisfy the growing domestic

demand, both because of the relatively high costs of production and the

inability to provide quality goods at competitive prices . Capital

inflow largely consisted of portfolio financial investments coupled

with export revenues which put additional pressure on the exchange rate

and led to high growth rates of prices, in particular on the stock

market and in the real estate market. FDI into Russia mostly were

concentrated not in manufacturing but in the extraction industries and

had a modest impact on production and efficiency growth. So, extremely

high rates of import growth (in 2007 import growth rates were 9 times

higher than export growth rates) became an important feature of the

Russian growth model.

Russian economic and monetary authorities had a difficult task of

trying to prevent a sharp appreciation in the currency which threatened

to make most of the manufacturing industry/sector uncompetitive on one

hand and fighting high inflation on the other hand. This contradictory

and inconsistent policy resulted in high foreign reserves of the

Central Bank and in high interest rates on the domestic financial

markets. The high cost of finance to some extent was facilitated by a

large accumulation of oil revenues in the state reserve funds (more

than $150 billion USD at the end of 2008). Due to financial resources

being too expensive inside the country, large Russian corporations and

banks sought short-term loans from the world financial markets that

were at that time providing extremely cheap loans because of excessive

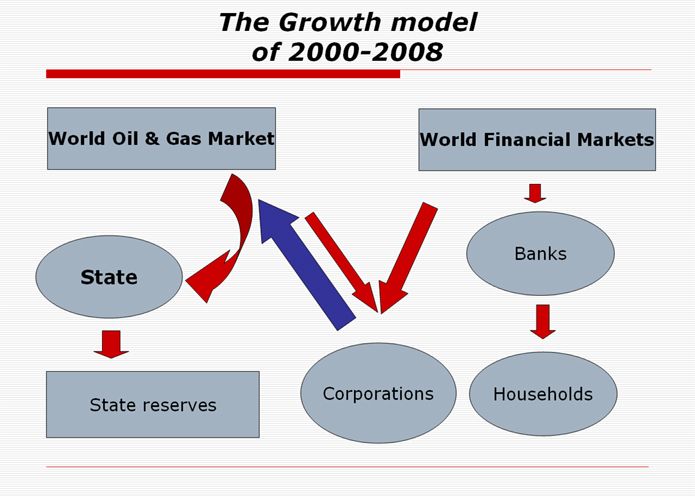

liquidity. Thus, the Russian growth model in 2002-2008 was based on the

state accumulating foreign reserves and simultaneously huge growth of

corporate debts which increased to about $500 billon USD.

Thus, the crash of world financial markets in 2008 immediately put both

the banking sector and the corporate sector in a very dangerous

position, making interference from the government and Central Bank

necessary to stabilize the situation. It has very little to do with

decreases in oil prices, though the problems were highlighted by the

drop in export revenues and a subsequent drop in the international

ratings of Russian corporations and national economy in general, which

made getting loans on the world markets very expensive and near

impossible to get.

Although those consequences of the crisis are more or less successfully

dealt with by the use of state reserve funds to substitute short-term

foreign loans, much more serious and strategic decisions are needed to

fight serious economic problems, caused by the falling prices of

Russian exports. The most important and complicated task for the

Russian government is to try to change the existing model of economic

growth, which has been based on using relatively cheap financing from

the world financial markets to invest mostly into such domestically

oriented industries as construction and real estate, retail trade and

services. The current crisis, while having evident negative

consequences in terms of industrial output decline and unemployment

growth, may have a positive impact on the Russian economy by

facilitating delayed structural and institutional reforms and by making

the Russian industry more efficient and competitive. Just nationalizing

struggling corporations and increasing protectionist policies is not an

option.

Dr. Kuznetsov is a Senior Researcher at the State University - Higher

School of Economics and Chief Researcher at the Interdepartmental

Analytical Center in Moscow. He specializes in the field of Industrial

policy and research of Russian industrial firms’ behavior. He is the

author of a number of publications on industrial development in Russia.

Recent publications include “Russian Industry at the stage of economic

Growth” (Gonchar K and Kuznetsov B. eds.), HSE, “Vershina” Publishing

house. Moscow. 2008; a chapter on the productivity of Russian

manufacturing (with Mark Schaffer) in “Can Russia Compete? Enhancing

Productivity and Innovation in a Globalizing World” (Raj M. Desai and

Itzhak Goldberg eds.). Brookings Institution Press. 2008

*The views expressed in the essay belong

solely to the author and do not represent the official position of any

organizations to which the author is permanently or was temporarily

affiliated.

[index]

|